Six mine development projects of 2016

Earlier this month, Rio Tinto approved a $338 million iron-ore development of its Silvergrass mine in Australia. Though the development is still subject to approvals by the Western Australian state government, we take a look at six of the biggest mine development projects so far in 2016.

Vimy Resources, Mulga Rock project, Australia

The Mulga Rock project, located in the Great Victoria Desert of Western Australia, is expected to produce 1,360 tonnes per annum of uranium oxide as revealed in a pre-feasibility study in 2015. The site is the third largest undeveloped uranium deposit in Australia. The site received some good news earlier this year – receiving environmental approval from the Environmental Protection Agency (EPA)

The Project is expected to result in the creation of approximately 490 new jobs in Western Australia and to create payments of around A$19m per year to the State government in the form of royalty payments and payroll tax. The amount of uranium produced if used in nuclear reactors to displace coal fired electricity would offset more than 50 million tonnes of carbon dioxide equivalent emissions which is around 10%.

Nord Gold, Gross Mine, Russia

The Russian Gross mine, from Nord Gold, will require an approximate $250 million of capital as part of the company’s Gross Project. The project follows an extensive exploration programme to identify the Gross deposit and its reserves. The next stage of the project will see the construction of a low-cost large-scale Gross construction which is estimated to produce up to 230 thousand ounces of gold per year over a 17-year mine life, with first production expected in 2018. Construction officially started on the mine in June this year.

Rio Tinto , Oyu Tolgoi, Mongolia

Rio Tinto announced that it had approved of the $5.3bn development of the Oyu Tolgoi copper and gold mine in Mongolia in May this year. The project will see the company increase its copper output to 500,000 tonnes annually, with the current output at the mine around 175,000-200,000 tonnes per annum. First production at the newly developed underground mine is expected in 2020, with construction beginning this year.

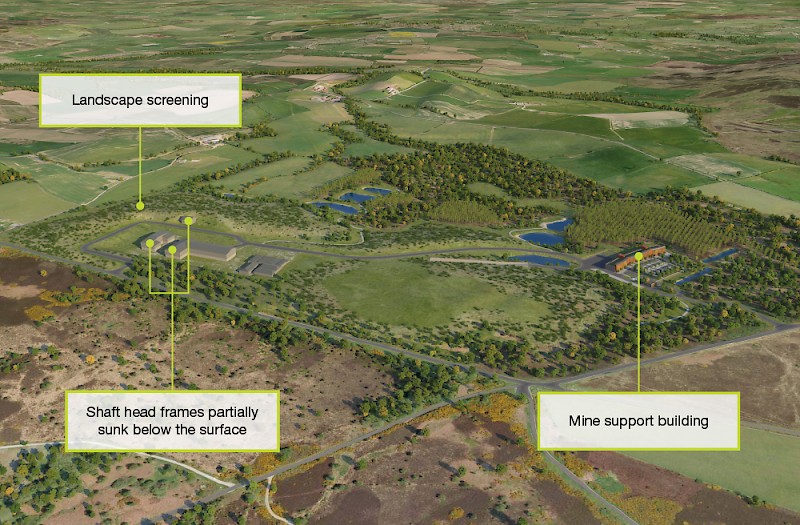

Sirius Minerals, Potash Mine, UK

The £2.4bn development of will be the largest Potash mine in the UK with the end goal of being a “world leader in the fertilizer industry”. Located in North Yorkshire, the deposit contains the largest, highest grade resource of polyhalite found anywhere in the world. The project will be developed in phases, with phase one capable of producing ten million tonnes per annum, creating the foundations for doubling production to 20 Mtpa. The project will also see a £2.3 billion annual contribution to UK GDP. The mine has received approval for plans by the North York Moors National Park authority in June this year, and has been given an estimated production date of 2021.

Codelco, Chuquicamata open pit copper mine, Chile

The Chuqui Underground project will see a complete transformation of a mine that dates back to 1915. Owners Codelco will invest $4.2billion in developing 143 km of tunnels, 19km of conveyer belts with the capacity to haul 150,000 mt/day of crushed rock 900 metres up to the surface. By extending the current open pit into an underground mine, Codelco has extended the mine life of Chiquicamata to at least 40 years. Production estimates show the mine to produce 140,000 t/d of ore, resulting in a production of 360,000 mt/y of fine copper and in excess of 18.000 mt/y of molybdenum.

Rio Tinto, Silvergrass mine, Western Australia

Last up we look at the titular Silvergrass mine development. Rio Tinto again – the company will invest an incremental $338 million to complete the development of Silvergrass as part of its Pilbara iron ore operations in Western Australia. The development will see the replacement of road haulage with a primary crusher and a more efficient 9km conveyor system that will link Silvergrass to the existing processing plant at the nearby Nammuldi mine.

- Ivanhoe founder says copper prices could jump tenfoldSupply Chain & Operations

- Rio Tinto and China Baowu collaborate for low-carbon shiftSupply Chain & Operations

- Rio Tinto to build desalination plant to secure water supplySustainability

- Rio Tinto begins construction of new billet casting centreSupply Chain & Operations