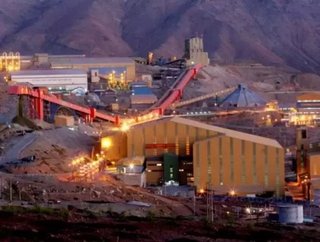

Survey: Mines in Latin America most likely to increase spending

Mines in Latin America are more likely to increase spending over the next 12 months than any other region, according to a new survey.

Timetric’s Mining Intelligence Center (MIC) surveyed 630 mine managers to outline their planned changes in expenditure on site for the next 12 months, compared to the prior year, with respondents asked to choose from ‘significant increase’, ‘slight increase’, ‘stay the same’, ‘slight reduction’ or ‘significant reduction’.

• Related content: Survey: Latin American miners unhappy with OEMs, cost of maintenance and servicing

The survey found that 16 percent of respondents in Latin American cited ‘significant increase’ in their spending for the coming year, with only 10 percent in Africa, nine percent in Asia, four percent in Europe and Australia, and three percent in North America.

Results from the survey were analyzed with the number of operating mines in each region undergoing expansion. MIC found that Latin America had the second-highest share of operating mines currently in expansion with 15 percent, compared with Africa (13 percent), Asia (seven percent) and North America (two percent).

“Latin America has a higher share of mines planning substantial increases in their spending within the next 12 months than any other region, and with the final decisions regarding equipment purchases being mainly decided at the mine site level, OEMs and their resellers need to ensure they are close to the customer to benefit from these additional investments,” said Nez Guevara, Senior Mining Analyst at Timetric’s MIC.

The survey is based on Timetric’s report -- Purchasing Trends and Intentions for Mining Equipment, Parts and Consumables in Latin America, 2015. Over 51 percent of survey respondents were decision-makers currently working operating mines.

• Related content: [PHOTOS] 5 of the most staggering facts about the Mponeng Gold Mine

Earlier this month, Timetric released its ‘Winning and Retaining Business in the Mining Equipment Sector in Latin America 2015’ report, which surveyed 100 key decision-makers at mines throughout Chile, Peru and Brazil, and found the majority of respondents were unhappy with their OEMs.

“Timetric’s research demonstrates the current mindset of mining companies in Latin America and the importance placed on minimizing costs throughout the business,” said Guevara.

“This includes costs associated with the maintenance and servicing of heavy mining equipment. Mining companies have outlined their dissatisfaction with these costs and have indicated plans to switch OEMs within the next five years.”

Stay connected! Follow us on Twitter and like us on Facebook