English judge blocks £5bn Brazil lawsuit against BHP

A £5 billion English lawsuit against Anglo-Australian mining giant BHP has been struck out, in a blow to a 200,000-strong Brazilian claimant group seeking damages after a devastating dam failure in 2015.

According to a Reuters report, a High Court judge in Manchester has ruled that managing the largest group claim in English legal history would be like “trying to build a house of cards in a wind tunnel” and that the case is an “abuse of the process of the court”.

BHP welcomed the decision, the report adds, stating that it reinforced its view that victims should pursue claims in Brazil and that the case duplicated ongoing work and legal proceedings there.

Tom Goodhead, a lawyer at PGMBM representing the claimants, says the judgement is “fundamentally flawed” and vowed to appeal.

“We will continue to fight ceaselessly, for however long it takes, in any court in the world, to ensure that BHP are held accountable for their actions,” he states.

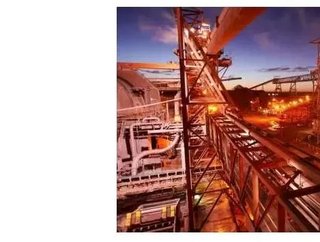

In 2015, the collapse of the Fundao dam, which is owned by the Samarco joint venture between BHP and Brazilian iron ore mining giant Vale. The collapse killed 19 and sent a torrent of mining waste into communities, the Doce river, and the Atlantic Ocean, 650 kilometres away. It was Brazil’s worst environmental disaster.

The case is the latest battle to establish whether multinationals can be held liable for the conduct of subsidiaries operating abroad, the Reuters report says.

The ruling comes 18 months after the UK Supreme Court ruled that nearly 2,000 Zambian villagers could sue miner Vedanta in England for alleged pollution in Africa, because substantial justice was not obtainable in Zambia.

Martyn Day, partner at Leigh Day, the firm who represented the Zambian villagers, says that he takes his hat off to the Brazilian claimant’s legal team for having the guts to take on the vast case.

“The judge seems to me to have been tough on the claimants,” he says. “The question for the appeal court will be whether or not he was too tough,” according to the Reuters report.

Claimants allege that senior BHP executives sat on Samarco’s board, and that BHP representatives approved of plans to repeatedly ramp up the dam’s capacity, ignoring safety warnings. They assert that the victims have no prospect of proper compensation in Brazil within a reasonable timeframe.

Lawyers for the claimants, who include municipalities, indigenous people, businesses and churches, also argue that under Brazilian law, liability for environmental damage could be imposed on a defendant’s ultimate owner.

Both BHP and Vale say that they have donated £1.29 billion into the Renova Foundation, which was set up in 2016 by BHP’s Brazilian division, Samarco and Vale to manage 42 reparation projects, including providing financial aid to indigenous families, rebuilding villages and establishing new water supply systems.