Event: Mines and Money Hong Kong 2015

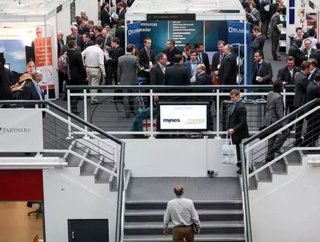

The 8th Annual Mines and Money Hong Kong event commenced yesterday at the Hong Kong Convention & Exhibition Centre with more than 1,500 investors, financiers and mining developers in attendance, making it the largest mining investment conference in Asia.

Over 600 investors from 26 countries have registered, with a geographic concentration from Hong Kong and China. A pre-event survey conducted by Mines and Money indicated that 52% of registered investors have over $100 million of AUM and that 46% of investors are interested in mining companies with a market cap of under $100 million.

This year's high caliber speaker line-up of 150 industry leaders includes:

• Robert Friedland, Chairman of Ivanhoe Mines

• Nev Power, CEO of Fortescue Metals Group

• Frank Holmes, CEO and Chief Investment Officer of US Global Investors

• Doug Casey, Chairman of Casey Research

• The Hon Andrew Robb AO, MP Minister for Trade and Investment, Australia

Mines and Money is the leading international event series for capital-raising and mining investment, where investors and developers come together to network, hear market analysis, compare investment options and share knowledge.

The annual event delivers a platform for financiers and investors to seek mining investment opportunities, and global mining industry leaders to identify funding for their projects. The latest trends, intelligence and market updates of the mining industry will also be shared at the conference, forming a week of valuable learning, high-value networking and abundant deal-making opportunities.

The conference program will be interspersed with 10-minute company presentations from mining companies, each showcasing their unique investment opportunities; as well as panel discussions hosted by investors and industry analysts to address on key topics and issues.

On 26th March Thursday night the Mines and Money Gala Dinner is the setting for the Asia Mining Awards. These awards will celebrate the best and brightest from across Asia-Pacific's diverse mining industry. Categories include:

• Asian Country Award

• Asian Exploration Award

• Asian Corporate Development Award

• Asian Large Cap Deal of the Year

• Asian Exploration Deal of the Year

• Asian Mid Cap Deal of the Year

• Asian Chief Executive of the Year

• Lifetime Achievement Award

Read the entire press release here.

- AIMEX 2023 offers decarbonisation and transformative techSustainability

- Ivanhoe Mines looks to fast-track expansion at Kamoa-KakulaSupply Chain & Operations

- Ivanhoe Mines: Kamoa-Kakula sets production record in DRCSupply Chain & Operations

- Ivanhoe and China’s CNMC to work together in AfricaSupply Chain & Operations