Low carbon world needs $1.7trn in mining investment

According to a new report from consultancy Wood Mackenzie, mining companies need to invest nearly $1.7trn in the next 15 years to help supply enough copper, cobalt, nickel and other metals needed for the shift to a low carbon world.

Cutting carbon emissions

The United States, Britain, Japan, Canada and others raised their targets on cutting carbon emissions to halt global warming at a summit in April hosted by US President Joe Biden.

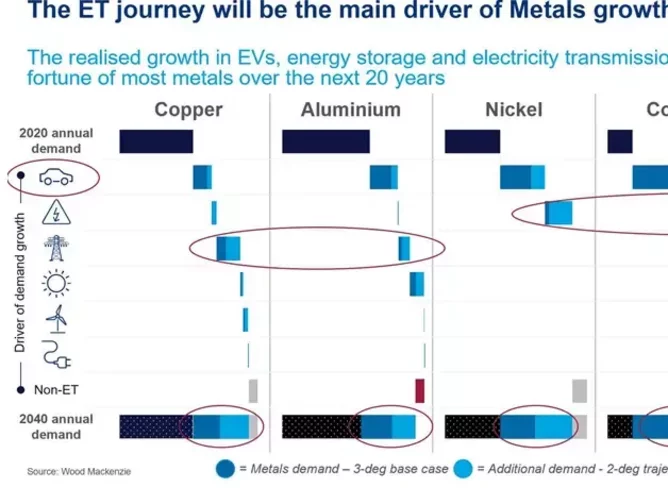

Meeting those targets will need large-scale deployment of electric vehicles, storage for power generated from renewables and electricity transmission, all of which require industrial materials, such as lightweight aluminium and metals used in batteries such as cobalt and lithium.

Wood Mackenzie

Wood Mackenzie analyst Julian Kettle calculated miners needed to invest about $1.7trn during the next 15 years to “deliver a two-degree pathway - where the rise in global temperatures since pre-industrial times is limited to 2°C”.

“At an industry level, there seems to be reticence around investing sufficient capital to develop future supply at the pace and scale demanded by the energy transition (ET),” he said.

Mining firms are wary of making heavy investments after their experience of the last decade when they invested in new capacity just as demand peaked, leading to a collapse in prices and revenues. They also need to please investors, who are unlikely to want to see dividends diverted to capital spending.

ESG

Rising demands of investors related environment, social and governance (ESG) issues further add to the challenge.

Australia, Canada and Western Europe carry a low ESG risk but some of the best resources are in high-risk areas, such as Democratic Republic of Congo, which sits on about half the world’s cobalt reserves according to the U.S. Geological Survey. “Given the need to meet tough decarbonisation and ESG targets, Western governments, lenders, investors and consumers will need to get comfortable operating in jurisdictions where ESG issues are more complex,” Kettle said.

Kettle said government support was needed to help miners comply with ESG issues to ensure production from high-risk areas was conducted in an acceptable way to consumers.

“Then, and only then, will the West be able to secure sufficient volumes of the raw materials needed to pursue the energy transition in the timescales envisaged.”

Digital Solutions

Digital solutions to enhance decarbonisation and support sustainability efforts in heavy industries like mining are being offered by Oren, a B2B marketplace conceived by Shell and IBM, and Axora.