Mongolian Government 'Made Mistakes' in Delaying Rio Tinto Copper Exploration

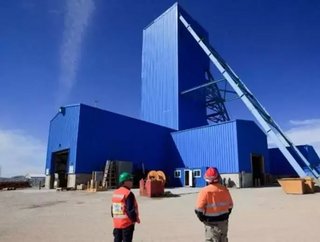

Good news for Rio Tinto – its stalemate with the Mongolian government over its Oyu Tolgoi copper mine site appears to be coming to an end. The Mongolian government has admitted that it made some mistakes in putting the Rio Tinto project on hold and, with that, all complications should be fully resolved by September.

According to Reuters, Mongolian vice minister for economic development Chuluunbat Ochirbat discussed the issue this week and noted that the Mongolian government realizes that it made mistakes in delaying Rio Tinto’s copper exploration at Oyu Tolgoi and is working on moving past this issue:

"We are under arrangements and negotiations with Rio Tinto now to complete the process by September this year," he said on the sidelines of a conference in London. "Underground mining will be put into operation in a year and a half or two years time," he added.

Mongolia’s decision to delay underground mining work may have hurt Rio Tinto’s production timetable, but one thing that officials have ruefully noted is that the delay has likely hurt Mongolia more – Reuters notes that the Oyu Tolgoi mine holds the potential to contribute 20-30 percent of Mongolia’s economy and, what’s more, the government’s delays may have hurt Mongolia’s potential to attract business in the future:

"The ongoing negotiation process with Rio Tinto has really hurt the reputation of Mongolia as a reliable partner for businesses and investors," [Ochirbat] said.

[…] "We have made the conclusion that we have made some mistakes in the legislation, we tightened regulations in the mining industry too much and that was the reason why we showed weaker performances (last year)," Ochirbat said, referring to a slowdown in GDP growth for the country in 2013.

According to Ochirbat, Mongolia is taking full responsibility for the standoff and hoping that the issues it caused can be reversed. If Rio Tinto is able to get its underground mining operation constructed and running within the projected two years with beneficial results, then that may well be the case.

- Rio Tinto and China Baowu collaborate for low-carbon shiftSupply Chain & Operations

- Rio Tinto to build desalination plant to secure water supplySustainability

- Rio Tinto begins construction of new billet casting centreSupply Chain & Operations

- Rio Tinto publishes site-by-site water usage dataSustainability