Pilot Gold Shares Rise after Successful Gold and Copper Drilling in Turkey

Successful drilling results of a new porphyry target in Turkey resulted in Pilot Gold Limited shares jumping by nearly five percent this week.

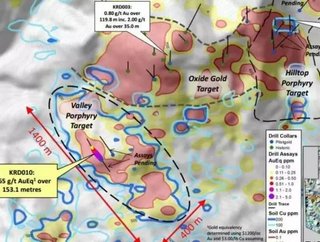

The discovery of gold and copper at the Valley Porphyry, part of the Vancouver-based company’s TV Tower Project, is the third such discovery made in the Biga district which lies in the northwest of Turkey.

Pilot Gold reported that it found 0.99 grams/ton of gold and 0.39 percent copper, or 1.65 grams/ton gold-equivalent over 153.2 metres.

The Valley Porphyry discovery was made through systematic exploration that came together from initial concept to discovery in six months, involving comprehensive soil sampling.

By the close on Wednesday the stock was changing hands for $1.50, up 4.9 percent on the Toronto Exchange. The $153 million company's stock is down from March highs, but for the year is up an enormous 74 percent.

TV Tower is a joint venture between Pilot Gold (40 percent) and Teck Madencilik Sanayi Ticaret A.S. (60 percent), a Turkish subsidiary of Teck Resources Limited (“Teck”). Pilot Gold is project operator at TV Tower and can increase its interest in the project to 60 percent, through sole funding of exploration over a three-year period.

Pilot Gold has three key assets include Kinsley Mountain project in Nevada and the TV Tower and Halilaga projects in Turkey.

- Luca Mining's Tahuehueto to double throughputSupply Chain & Operations

- Peter Mah named President and CEO of Spanish Mountain GoldSupply Chain & Operations

- SSR Mining acquires 40% stake in Hod Maden from Lidya MinesSupply Chain & Operations

- Gold price nears 7-month peakSupply Chain & Operations