Australian mining magnate plans global green energy drive

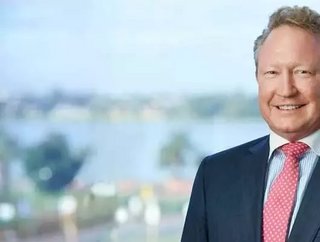

Australian mining magnate Andrew Forrest has outlined ambitious plans to build a renewable energy business, aiming to compete with oil giants to provide low-cost green energy globally.

The billionaire owner of Fortescue Metals Group – the world’s fourth-biggest iron ore miner - says Fortescue Future Industries (FFI) has signed preliminary deals in countries like Papua New Guinea, as well as in African countries, and a team of executives is looking for other partners.

“We are building a portfolio of renewable assets, energy producing assets around the world,” Forrest, Fortescue’s chairman, told the company’s annual meeting via video link from Paraguay, according to a Reuters report.

He adds that Fortescue has already committed £550 million out to 2023 for the project and expects to use off-balance sheet financing for it as well.

“With scale and innovation, we will be able to ramp up supply of green hydrogen and green ammonia to deliver low cost energy reliably at industrial scale to customers all over the world,” he states, explaining that hydrogen and ammonia fuel cells are set to be used in transport and shipping, ammonia in fertiliser and hydrogen also in steel making.

Forrest, whose net worth is estimated at around £13 billion, says that the company’s initial target would be to have 235 gigawatts (GW) of installed energy capacity, but did not provide a timeline for when this would happen.

Gero Farruggio, head of global renewables at research firm Rystad Energy Farruggio, says that such a target would be extremely challenging to achieve, pointing out that energy major BP, by comparison, plans to produce 50GW of renewable energy by 2030.

Despite the coronavirus pandemic, Forrest has been touring the world and says that executives have visited 23 countries to shortlist partners for the venture, and plan to visit 24 more, with investments tied to human rights obligations and equal opportunities.

Fortescue has committed its own operations to be carbon neutral by 2040 and has been accumulating licenses and patents during the last five years to further its plans.

Forrest’s net worth has tripled over the last year, according to Australia’s Financial Review Rich List. Fortescue posted a net profit of £3.5 billion in 2019, due to a mix of high prices for iron ore and better margins for its products.