B2Gold commissions world's largest off-grid solar plant

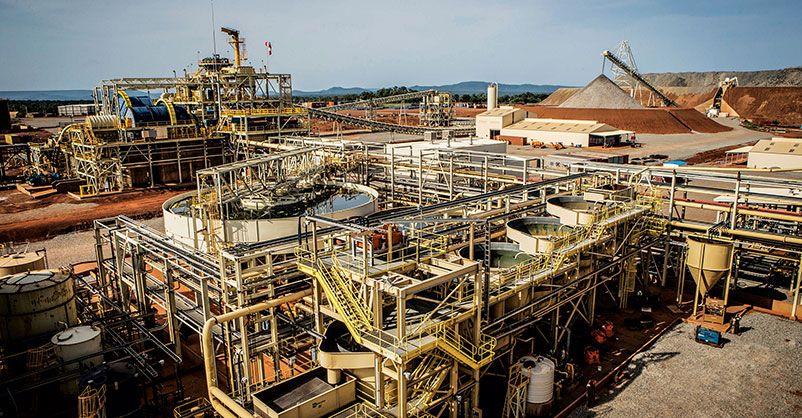

Suntrace and BayWa r.e., together with B2Gold, have completed commissioning of the world’s largest off-grid solar-battery hybrid system for the mining industry, at the Fekola gold mine in Mali, West Africa.

The solar-battery hybrid plant was integrated and commissioned successfully with the existing power plant operation, and the solar plant is on course to be 100% complete by the end of June this year.

B2Gold

Hybrid projects such as this, which combine solar energy with conventional energy generation and battery storage, are an effective way to provide reliable power supply day and night in off-grid areas. Ideally suited to their needs, B2Gold approved the hybrid project for implementation in July 2019, following completion of preliminary studies by Suntrace and BayWa r.e..

The Fekola gold mine operates 24-hou rs a day. During the daytime, the new 30 MW solar plant allows three out of six heavy fuel oil generators to be shut down; the energy production of the residual three generators could also be significantly reduced. The 15.4 MWh battery storage compensates energy generation fluctuations and assures a reliable operation, which allows up to 75% of the electricity demand of the gold mine to be covered by renewable energy during the daytime.

Dennis Stansbury, Senior Vice President at B2Gold, commented: “Suntrace and BayWa r.e. have played a vital role in our work towards more sustainable production at Fekola. The implementation of a solar-battery hybrid system was an obvious choice to help achieve this, not only for its environmental credentials, but also its economic viability. This is a landmark project which we expect to pave the way for more sustainable power generation within the mining industry in West Africa.”

The integration of the solar power plant with the battery system will ensure safe and reliable power, saving 13.1 million litres of heavy fuel oil (HFO) a year. The close collaboration of all three parties as one team was vital to implementing this complex project, helping to realise the huge potential of solar battery hybrid systems.

Suntrace

Martin Schlecht, COO at Suntrace, said: “We are very proud that B2Gold has entrusted Suntrace, together with BayWa r.e. as Engineering and Procurement contractor, to support the development and implementation of this innovative project. Thanks to excellent team work with B2Gold and BayWa r.e., we were able to manage the completion despite the global challenges that the COVID-19 pandemic imposed on all of us. We are proud to jointly deliver a functioning project, well integrated with the mining operations, which reduces CO2 emissions from power generation for the Fekola mine by roughly 20%.”

The PV-battery system will help to reduce CO2 emissions by 39 000 tonnes per year.

Baywa r.e

Thorsten Althaus, Project Manager at BayWa r.e., added: “Integrating such a large amount of solar into a small, isolated grid safely and reliably has been a major technical challenge and required the use of battery storage as well as a tailor-made control system. This was conceptualised in the early stages of the project and we ensured that our vision was implemented accordingly by the suppliers. It is extremely rewarding to see how well this solution performs in reality and shows that the technology works and is just waiting to be applied on further projects.”

B2Gold expects to produce between 530,000 to 560,000 ounces of gold at Fekola, one of the world’s largest gold mines, this year.

Featured Articles

Rio Tinto completed its US$6.7bn acquisition of Arcadium Lithium, making it a key company in raw materials mining for batteries in the energy transition

Intel first began to work towards responsibly sourced conflict minerals from the Democratic Republic of Congo and adjoining countries about 12 years

International Energy Forum says mining is the 'paradox' at heart of quest for clean energy but recognises the industry is addressing sustainability issues