Gold miners on track to meet 2030 emissions targets - report

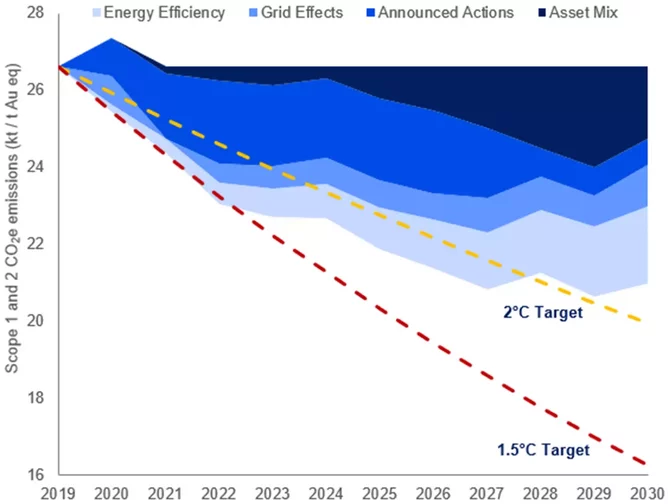

The global gold industry* is broadly on track to align with a 2°C climate target by the end of the current decade. However, more action is required if the industry is to meet – and surpass – the 1.5°C mark, according to a new report from Wood Mackenzie.

Gold production is getting greener

To assess the pace of the greening of gold, Wood Mackenzie’s analysis plots the forecast progress of gold miners out to 2030 against the reduction in emissions required to align with the 2°C and 1.5°C targets.

To date, the cleaner energy projects that have been implemented and planned are anticipated to result in savings of over 3Mt CO2 equivalent per year, which is 5.5% of the gold industry’s total 2019 emissions. This is equivalent to removing approximately 654 thousand internal combustion engine cars ** from the roads.

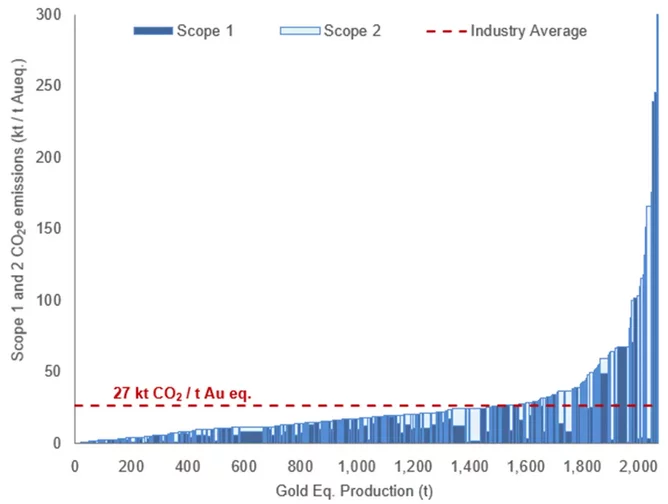

According to estimates taken from Wood Mackenzie’s Emissions Benchmarking Tool, the gold industry emitted over 55Mt of CO2 equivalent in 2019 in scope 1 and 2 emissions, which is approximately 0.2% of total global carbon emissions. Though this is small in comparison to other areas within the energy sector, gold miners must not become complacent in the drive towards a more sustainable mining sector.

Focus on the environment as part of ESG efforts is greater than ever before

Rory Townsend, Wood Mackenzie Head of Gold Research, commented: “The gold industry cannot afford to rest on their laurels. The focus on the “E” in ESG has never been greater and with COP26 taking place later this year, we expect the spotlight on sustainability to intensify.

“Miners who are not striving to reduce their environmental footprints are likely to lose favour among investors and struggle to secure project financing. Proof that this is not a box-ticking exercise is evidenced by several miners executing sustainability-linked credit facilities, such as those agreed by Newmont in March and Polymetal increasing theirs in May.”

The location of gold assets in operation is expected to be an important determining factor in reducing emissions, with several carbon-intensive mines due to go offline before 2030. However, in the past 12 months, mine life extensions are materialising alongside the elevated gold price at companies such as Equinox, Alamos and Yamana. Ultimately, if mine life extensions continue, Wood Mackenzie says the industry may need to see even more aggressive action to reduce emissions to align with carbon reduction targets.

Townsend added: “It is apparent that some mines have a lot more ground to cover than others. Those that are beholden to carbon-intensive grids could struggle unless the process to approve onsite renewable alternatives accelerates markedly.

“The focus on carbon emissions in the gold sector is here to stay. While cleaner energy projects are coming thick and fast, the bulk of progress so far has come from 15 companies. To change the perception of the industry, however, it needs to be a collective effort. This is an opportunity for miners to boost their green credentials, particularly at a time when other asset classes, such as cryptocurrency, are having their sustainability commitments drawn into question.”

*Gold industry refers to 339 large-scale gold mines, or 60% of total gold mine supply. Gold production originating from primarily copper, zinc and nickel mines is excluded from this analysis. Additionally, this does not include an assumption for small-scale, informal, artisanal or illegal mining due to the opaque nature of supply.

** A typical internal combustion engine passenger vehicle as disclosed by the EPA