Discover which 5 Canadian gold mines are doing well

Kirkland Lake, Ontario seems to be a booming place for gold miners in Canada.

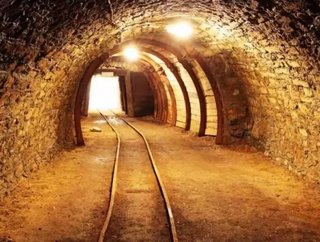

Underground in Kirkland Lake, some 300 kilometers north of Sudbury, crews are currently working 5,400 to 5,600 feet below the surface — and it’s hot!

In fact, known as one of Canada’s deepest gold mines, mining this far down is quite challenging and not for the weak of heart. The heat and humidity in the mines are quite overpowering. First time visitors would most likely find the surrounding temperatures suffocating.

RELATED TOPIC: [INFOGRAPHIC] Looking at the high-grade gold capital of Canada

But despite these troubles, as well as the gloomy price of gold, this North Ontario mine is still as active as ever — even 100 years after the first shaft was originally sunk.

RELATED TOPIC: Atrum Coal invests in anthracite mine in Canada

Originally reported by our sister brand Business Review Canada, the Kirkland Lake operation, also known as Macassa, is one of the world’s richest gold mines by all measures. It has the kind of high-quality operation that was built to withstand even the worst bear market in gold.

And it’s not the only one! Four other mines are still making a name for themselves.

Other small and medium-sized Canadian gold producers in the region have been able to create turnarounds, even though they were once left for dead. Following in Kirkland Lake Gold’s footsteps are Detour Gold Corporation, Lake Shore Gold Corporation, Claude Resources Inc. and Richmont Mines Inc.

It looks as if major operational improvements have also assisted with this success. These mines have re-aligned business plans to become prosperous in a low-environment by raising money where necessary and then investing it.

“We’ve all put in optimization plans and turned our operations around, “ said George Ogilvie, Kirkland Lake Gold’s chief executive.

Take a look at the following table provided KLGold.com and the Financial Post.

RELATED TOPIC: Discover why these are the top 5 mining companies in Canada

[SOURCE: Financial Post]

Stay connected! Follow us on Twitter and like us on Facebook